Prominent crypto analytics firm Swissblock says Bitcoin (BTC) may have yet to find a market bottom despite the US enacting a 90-day tariff pause.

Swissblock says on the social media platform X that Bitcoin’s momentum to the upside is not yet a sign of a convincing breakout.

“Don’t let your guard down yet! The 90-day trade war extension eases tensions, but we’re not out of the woods. Bitcoin breaks $78,000-$79,000, now holding above $80,000. Are we in the clear?”

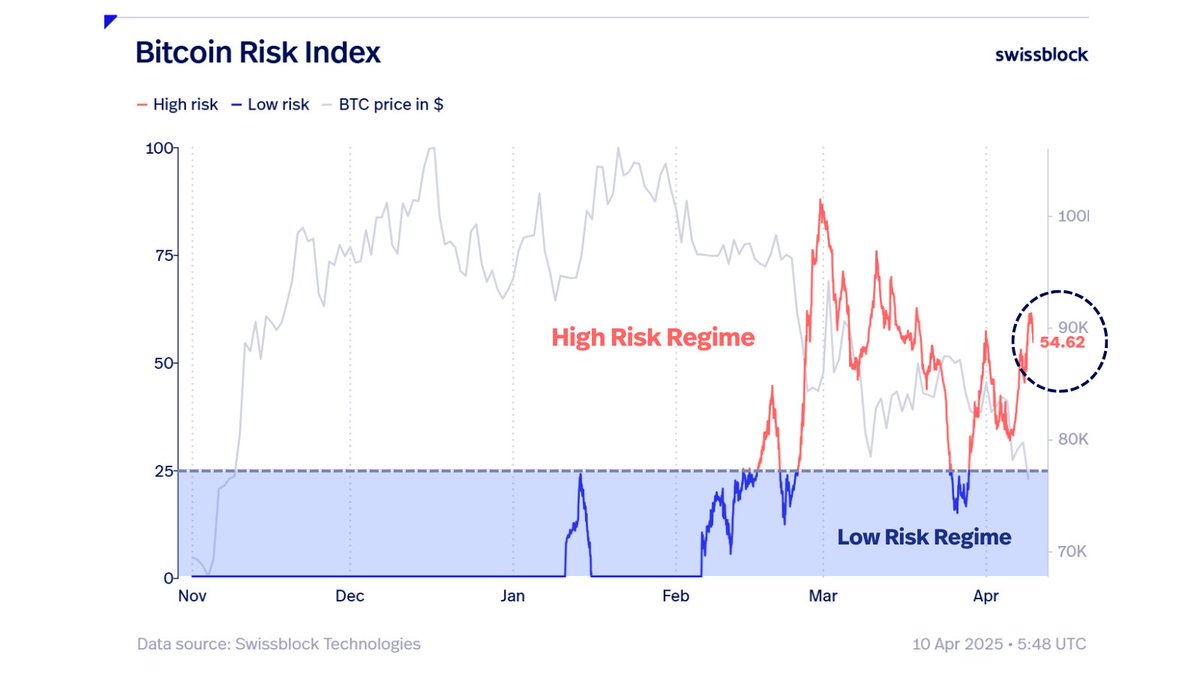

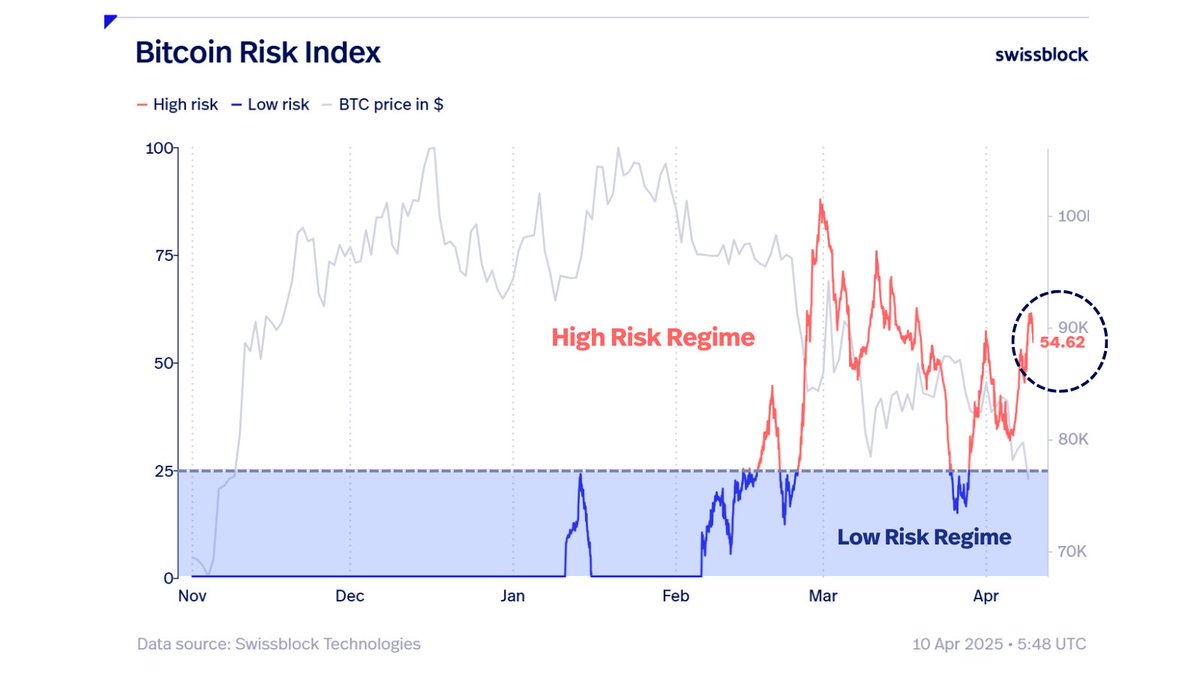

Swissblock says the Bitcoin Risk Signal – which uses several indicators, including price data, on-chain data and a selection of other trading metrics to gauge whether BTC is at risk of a major drawdown – is not yet indicating a market bottom has been reached.

“Market risk must ease for a true bottom. It’s under control but still elevated, not in a low-risk regime yet. We need to see a clear decline in risk.”

According to Swissblock, Bitcoin remains in a downtrend.

“For the bottom to progress, market trend must signal formation.

We’re in a downtrend phase, normal in bottoming cycles: bottom-downtrend-uncharted.

The bottom is close, but not confirmed.”

Swissblock says that for Bitcoin to confirm a bullish reversal, the flagship crypto asset needs to hold $80,000 as support.

“Bitcoin must hold $80,000 and consolidate to break the downward compression. Strength and volume are key for a bullish shift.”

Bitcoin is trading for $83,221 at time of writing, up 4.7% in the last 24 hours.

Follow us on X, Facebook and TelegramDon’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney